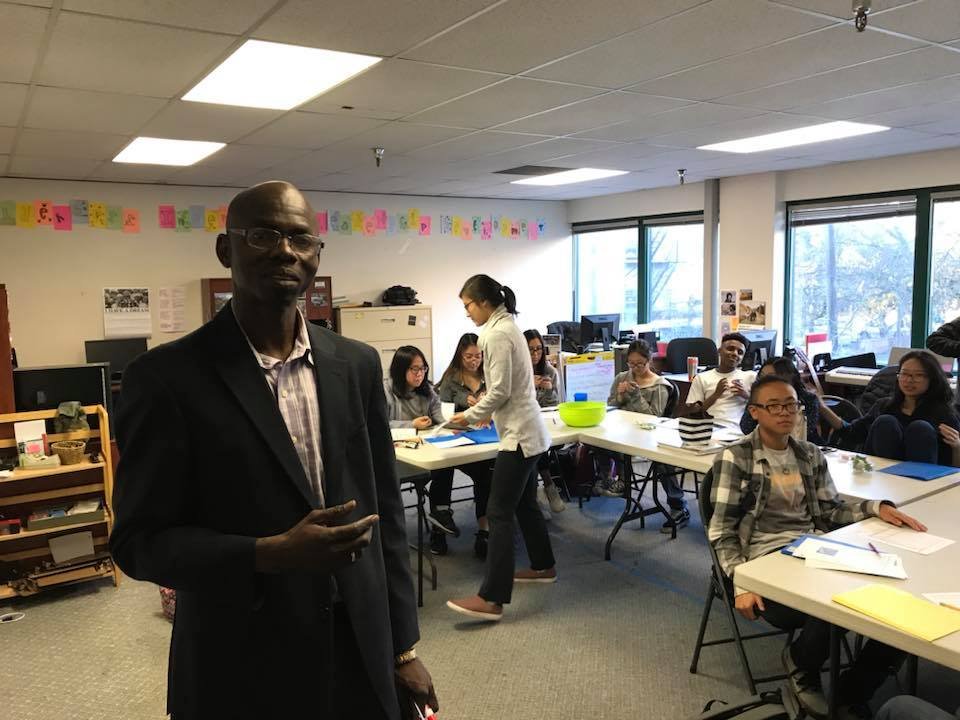

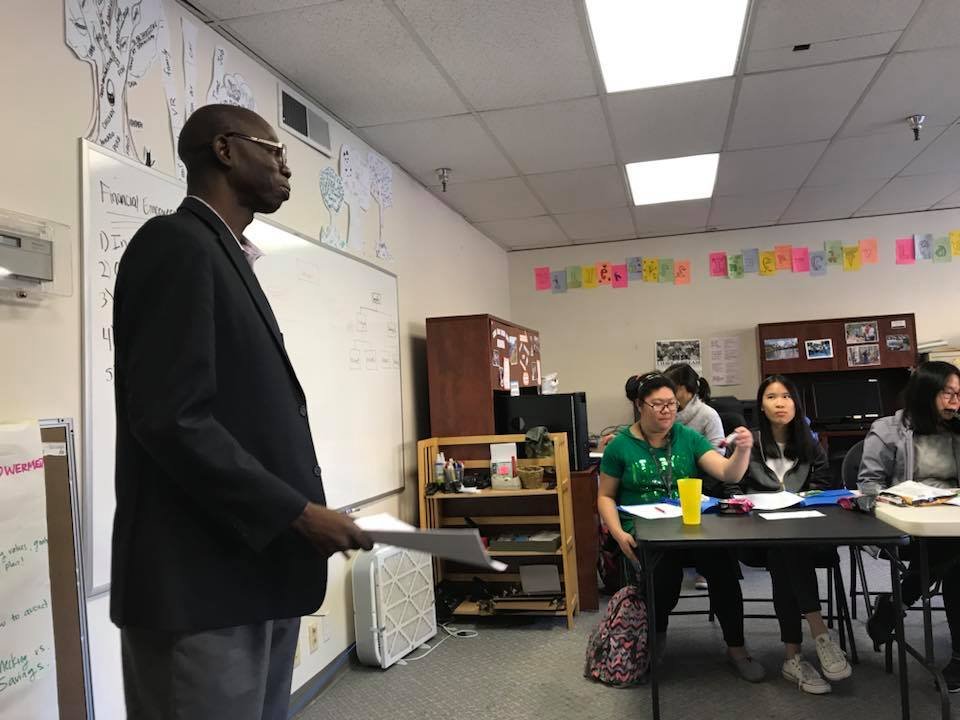

Financial Literacy

Empowering individuals and families with comprehensive financial knowledge to help them make informed decisions and build a secure future.

Breaking Barriers to Financial Empowerment

The Challenge

Low-income individuals often lack financial knowledge, leaving them vulnerable to scams, high-interest loans, and growing debt

Our Solution

Financial training helps low-income individuals understand lending risks, benefits, banking, saving, investing, and credit use

The Outcome

Financial confidence helps individuals avoid debt, make informed decisions, and build long-term economic stability

Our Financial Literacy Programs

Basic Banking and Budgeting

- Using financial institutions

- Reading statements from financial institutions

- Using electronic banking services

- Calculating interest and understanding compound interest

- Opening accounts

- Managing a checking account

- Recognizing the range of saving options

- Understanding the importance of budgeting to achieve goals

Credit and Debt Management

- Establishing and using credit

- Ordering and reading a credit report

- Identifying expenses and assessing assets/debts

- Understanding car ownership/leasing costs

- Repairing poor credit

- Securing loans

- Avoiding predatory lending

- Strategies to reduce debts and save money

Income Planning, Risk Management, and Taxes

- Financial planning for different life stages

- Understanding various types of insurance

- Decision-making and problem-solving

- Filing for Earned Income Tax Credit (EITC)

- Reading a paycheck (gross vs. net pay)

- How taxes affect paychecks

- Understanding tax obligations

- Avoiding tax penalties and overpayment

Money Flow and Asset Creation

- Money Flow and Asset Creation

- Recognizing the interconnectedness of the economy

- Applying economic concepts to personal finance

- Standing up for rights as a consumer

- Understanding basic investment principles

- Accessing community and financial resources

- Communicating about financial matters with family

- Recognizing accessible investment options

Individual Development Account (IDA)

- Understanding the IDA program

- Using the IDA to build assets

- Identifying barriers to achieving goals

- Monitoring plans and tracking progress

- Setting up, maintaining, and using the IDA

- Setting goals and priorities

- Developing a spending plan

- Keeping accurate records

Homeownership Preparation

- Knowing what to look for when buying a home

- Dealing with mortgage lenders

- Identifying affordable homeownership programs for low-income workers

Ready to Grow Your Business?

Starting or growing? We’re here to support you. Contact us with any questions or needs.